Understanding the Basic Forex Terms: Part 2

- ROMARK GROUP

- Aug 7, 2020

- 3 min read

Updated: Aug 8, 2020

Forex Pip

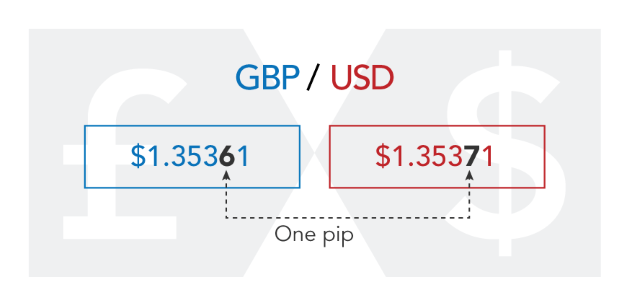

The unit of measurement to express the change in value between two currencies is called a “pip.” If EUR/USD moves from 1.1050 to 1.1051, that .0001 USD rise in value is ONE PIP.

A pip is usually the last decimal place of a price quote.

Most pairs go out to 4 decimal places, but there are some exceptions like Japanese yen pairs (they go out to two decimal places). For example, for EUR/USD, it is 0.0001, and for USD/JPY, it is 0.01.

How Forex Pip Works

A pip is a basic concept of foreign exchange (forex). Forex pairs are used to disseminate exchange quotes through bid and ask quotes that are accurate to four decimal places. In simpler terms, forex traders buy or sell a currency whose value is expressed in relationship to another currency.

Movement in the exchange rate is measured by pips. Since most currency pairs are quoted to a maximum of four decimal places, the smallest change for these pairs is 1 pip. There are forex brokers that quote currency pairs beyond the standard “4 and 2” decimal places to “5 and 3” decimal places. They are quoting FRACTIONAL PIPS, also called “points” or “pipettes.” That is a “point” or “pipette” or “fractional pip” is equal to a “tenth of a pip“. For instance, if GBP/USD moves from 1.30542 to 1.30543, that .00001 USD move higher is ONE PIPETTE.

How to Calculate the Value of a Pip

As each currency has its own relative value, it’s necessary to calculate the value of a pip for that particular currency pair. In the following example, we will use a quote with 4 decimal places. For the purpose of better explaining the calculations, exchange rates will be expressed as a ratio (i.e., EUR/USD at 1.2500 will be written as “1 EUR / 1.2500 USD”).

Example: USD/CAD = 1.0200

To be read as 1 USD to 1.0200 CAD (or 1 USD/1.0200 CAD)

(The value change in counter currency) times the exchange rate ratio = pip value (in terms of the base currency). Thus, [.0001 CAD] x [1 USD/1.0200 CAD]

Using this example, if we traded 10,000 units of USD/CAD, then a one pip change to the exchange rate would be approximately a 0.98 USD change in the position value (10,000 units x 0.00009804 USD/unit). We say “approximately” because as the exchange rate changes, so does the value of each pip move.

Finding the Pio Value in Currency Account Trading

The final question to ask when figuring out the pip value of your position is, “What is the pip value in terms of my trading account’s currency?” After all, it is a global market and not everyone has their account denominated in the same currency. This means that the pip value will have to be translated to whatever currency our account may be traded in. This calculation is probably the easiest of all; simply multiply/divide the “found pip value” by the exchange rate of your account currency and the currency in question.

Using our USD/CAD example above, we want to find the pip value of .98 USD in New Zealand Dollars. We’ll use .7900 as our conversion exchange rate ratio: 0.98 USD per pip X (1 NZD/.7900 USD). Hence, for every .0001 pip move in USD/CAD from the example above, 10,000 unit position changes in value by approximately 1.24 NZD. Even though you’re now a math genius–at least with pip values–you’re probably rolling your eyes back and thinking, “Do I really need to work all this out?” Well, the answer is a big fat NO. Nearly all forex brokers will work all this out for you automatically, but it’s always good for you to know how they work it out.

In the next lesson, we will discuss how these seemingly insignificant amounts can add up.

Comments